Inreoductions

The Europe Additive Manufacturing Market is witnessing robust growth as the region accelerates its transition from traditional production methods to digital manufacturing technologies. Additive Manufacturing (AM), commonly referred to as 3D printing, is reshaping Europe’s industrial landscape by enabling rapid prototyping, lightweight component production, and efficient low-volume manufacturing across industries such as automotive, aerospace, medical, and consumer goods.

-

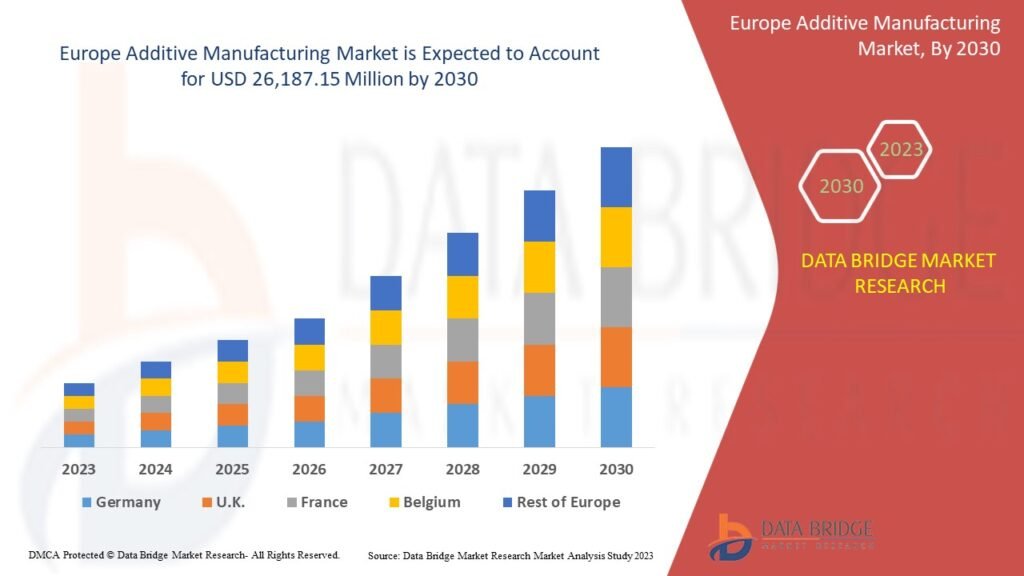

Market Size (2023): Approximately USD 6.2 billion

-

Forecast (2030): Expected to reach around USD 28 billion

-

CAGR (2024–2030): Around 23–24%

The demand for AM in Europe is being driven by the region’s focus on sustainability, digital transformation, and advanced manufacturing under the Industry 4.0 initiative.

https://www.databridgemarketresearch.com/reports/europe-additive-manufacturing-market

Key Market Drivers

1. Industrial Transformation and Industry 4.0 Initiatives

Europe’s heavy investment in digital manufacturing and automation under Industry 4.0 policies has accelerated AM adoption. Governments and industry bodies are promoting additive manufacturing as part of the drive toward sustainable and flexible production systems.

2. Growth in Aerospace and Automotive Applications

The aerospace and automotive sectors lead AM adoption in Europe. Aerospace manufacturers use AM to produce lightweight, high-strength metal components, while automotive OEMs and suppliers employ the technology for prototyping, tooling, and increasingly for final parts in electric vehicles.

3. Advancements in Metal 3D Printing

The transition from polymer-based 3D printing to metal additive manufacturing has been one of the major breakthroughs in Europe. Countries like Germany, France, and the UK are home to global leaders in metal powder bed fusion and direct energy deposition systems.

4. Expansion of AM Service Providers and Materials

The rapid rise of AM service bureaus and material suppliers across Europe has made the technology more accessible. Many traditional manufacturers are outsourcing AM production instead of investing directly in equipment, which is fueling market expansion.

5. Sustainability and Localized Production

Additive manufacturing supports Europe’s sustainability goals by minimizing material waste, reducing transport emissions, and enabling localized, on-demand production—key elements of the region’s circular economy vision.

Market Restraints

-

High Equipment and Material Costs: The cost of industrial 3D printers and certified materials remains a key barrier to entry for smaller firms.

-

Complex Certification Processes: Especially in aerospace and medical applications, qualification standards can be time-consuming and costly.

-

Skill Gaps: A shortage of trained AM engineers, designers, and post-processing technicians limits scaling.

-

Limited Scalability for Mass Production: While excellent for custom or low-volume runs, AM still faces challenges in high-volume manufacturing due to slower production speeds.

Market Segmentation

By Component

-

Hardware: 3D printers, scanners, post-processing systems

-

Materials: Polymers, metals, ceramics, and composites

-

Software and Services: Design tools, simulation software, and on-demand manufacturing

By Technology

-

Powder Bed Fusion

-

Stereolithography (SLA)

-

Fused Deposition Modeling (FDM)

-

Binder Jetting

-

Directed Energy Deposition (DED)

-

Material Jetting

By Material Type

-

Metals: Titanium, aluminum, stainless steel, cobalt-chrome

-

Polymers: Thermoplastics, photopolymers

-

Ceramics and Composites

By End-User Industry

-

Automotive and Transportation

-

Aerospace and Defense

-

Healthcare and Medical Devices

-

Industrial Manufacturing

-

Consumer Goods and Electronics

-

Tooling and Prototyping

By Country

-

Germany – Largest contributor, strong in industrial metal AM

-

United Kingdom – Focus on aerospace, research, and medical sectors

-

France – Strong presence in aerospace and automotive applications

-

Italy and Spain – Growing adoption in industrial design and manufacturing

-

Nordic and Eastern Europe – Emerging markets with fast technology diffusion

Regional Insights

Germany

Germany dominates the European market, accounting for over one-third of total revenue. The country’s robust automotive, aerospace, and industrial machinery sectors are rapidly integrating AM technologies for both prototyping and production.

United Kingdom

The UK market benefits from strong R&D capabilities, university-industry collaborations, and government funding for innovation in additive manufacturing, particularly within aerospace and healthcare.

France and Italy

France’s aerospace industry and Italy’s luxury automotive sector have become major AM users. These countries focus heavily on lightweighting, customized manufacturing, and reducing supply chain dependencies.

Northern and Eastern Europe

The Nordic region and Eastern European countries are adopting AM for industrial components and spare parts manufacturing, often as part of sustainability and digital-transformation initiatives.

Key Market Trends

-

Shift from Prototyping to Production

European manufacturers are scaling AM for serial production, particularly for customized and lightweight parts. -

Metal Additive Manufacturing Expansion

Rapid adoption of metal AM in defense, energy, and medical industries. -

Integration with AI and Simulation Tools

Design optimization, generative design, and process simulation are enhancing production quality and speed. -

Growth of AM Service Bureaus

Outsourced AM services provide small and mid-size manufacturers with access to advanced capabilities without heavy investment. -

Sustainability-Driven Manufacturing

AM supports material efficiency and circular economy objectives through waste reduction and part consolidation.

Forecast Analysis

| Metric | 2023 | 2030 (Projected) | CAGR (2024-2030) |

|---|---|---|---|

| Total Market Size | USD 6.2 billion | USD 28 billion | ~23–24% |

| Metal AM Share | ~35% | ~50% | Rapid Growth |

| Service & Software Segment | ~25% | ~30% | Growing |

| Germany Market Share | ~35% | ~37% | Leading Region |

The European AM market is set to maintain strong double-digit growth, driven by technology improvements, material diversification, and industrial policy support.

Competitive Landscape

Leading participants include global and regional companies specializing in 3D printers, materials, and services. Many have established R&D centers or production hubs in Europe to leverage the continent’s advanced manufacturing ecosystem.

Key focus areas among competitors include printer scalability, certification processes, multi-material printing, and AI-driven workflow optimization.

Strategic Recommendations

For Manufacturers

-

Identify high-value applications such as tooling, jigs, and low-volume parts for early AM adoption.

-

Integrate additive manufacturing into product development workflows.

-

Train engineering teams in AM design and process optimization.

For Material and Equipment Suppliers

-

Expand local supply networks for powders, polymers, and filaments.

-

Focus on sustainability certifications and traceable material sourcing.

-

Offer flexible pricing models and maintenance contracts to support SMEs.

For Policymakers and Investors

-

Encourage R&D incentives and collaborative innovation hubs.

-

Support skill-development programs to address the talent gap.

-

Invest in circular manufacturing ecosystems using additive methods.

Conclusion

The Europe Additive Manufacturing Market is entering a dynamic phase of industrial adoption. With strong government support, a mature manufacturing base, and accelerating innovation, Europe is set to remain a global leader in AM technology. While cost and certification hurdles persist, ongoing material and process innovations are steadily addressing these limitations. By 2030, additive manufacturing will become a core pillar of Europe’s advanced manufacturing strategy, enabling sustainable, localized, and efficient production across multiple industries.