Compare cash vs. accrual accounting for startups. Learn which suits your business with expert tips on accounting and bookkeeping services.

The choice between accrual and cash accounting will affect how your company tracks cash to plan growth and is compliant. Ceptrum is a company that provides accounting and tax services.

Ceptrum, we assist businesses in making smart choices regarding their finances through our professional Accounting and Bookkeeping Services For Startups.. If you’re employing Xero’s accounting software, QuickBooks for small businesses or tax services for startups knowing the two approaches is crucial for building a solid financial base.

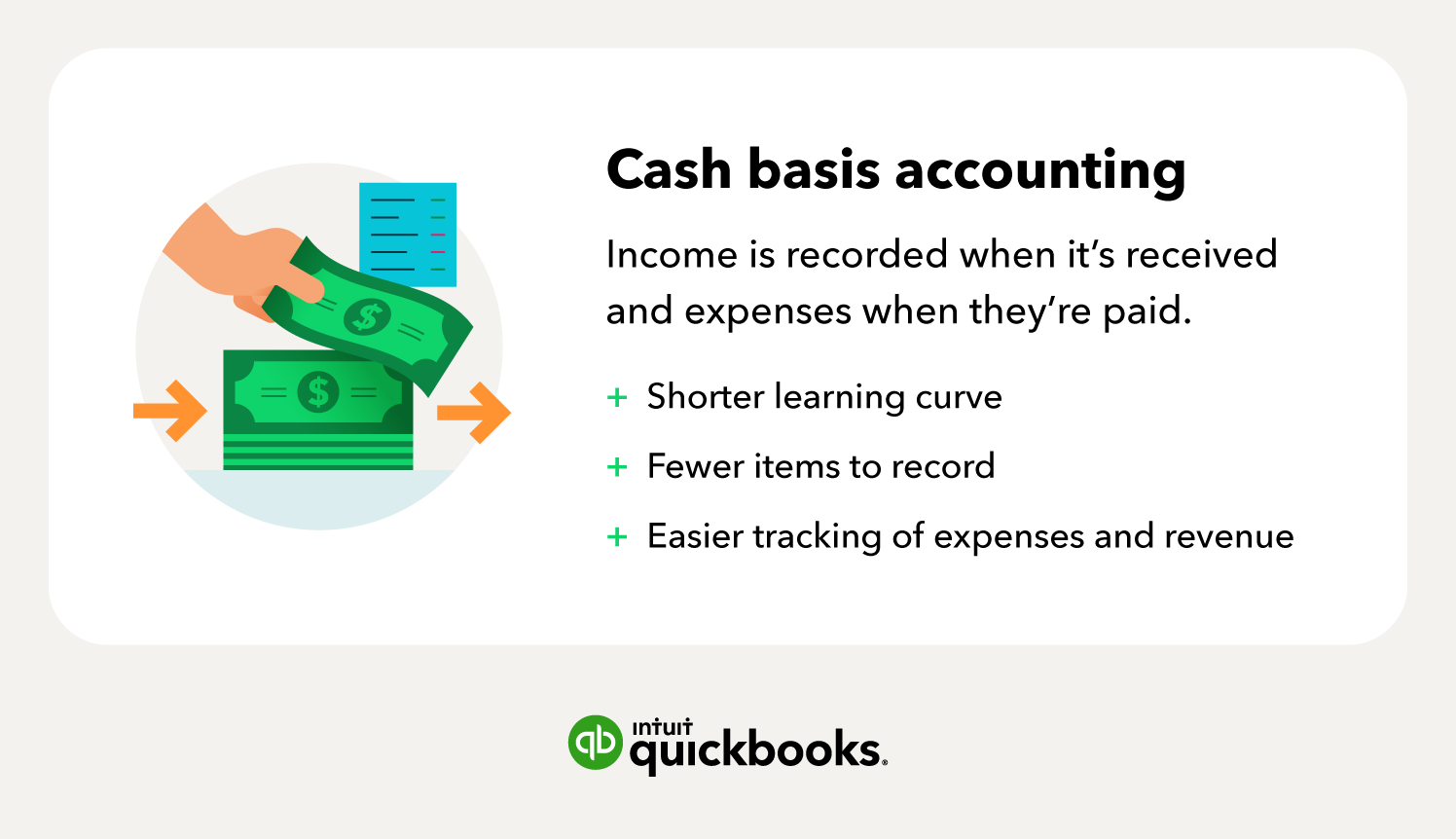

1. What Is Cash Accounting?

Cash accounting tracks the income and expenditure in the event that money moves.

- Simple and Easy to manage It is ideal for young companies.

- Real-Time Cash Transfer You will always have an idea of how much cash accessible.

- Ideal for small-sized businesses that have easy transactions and little stock.

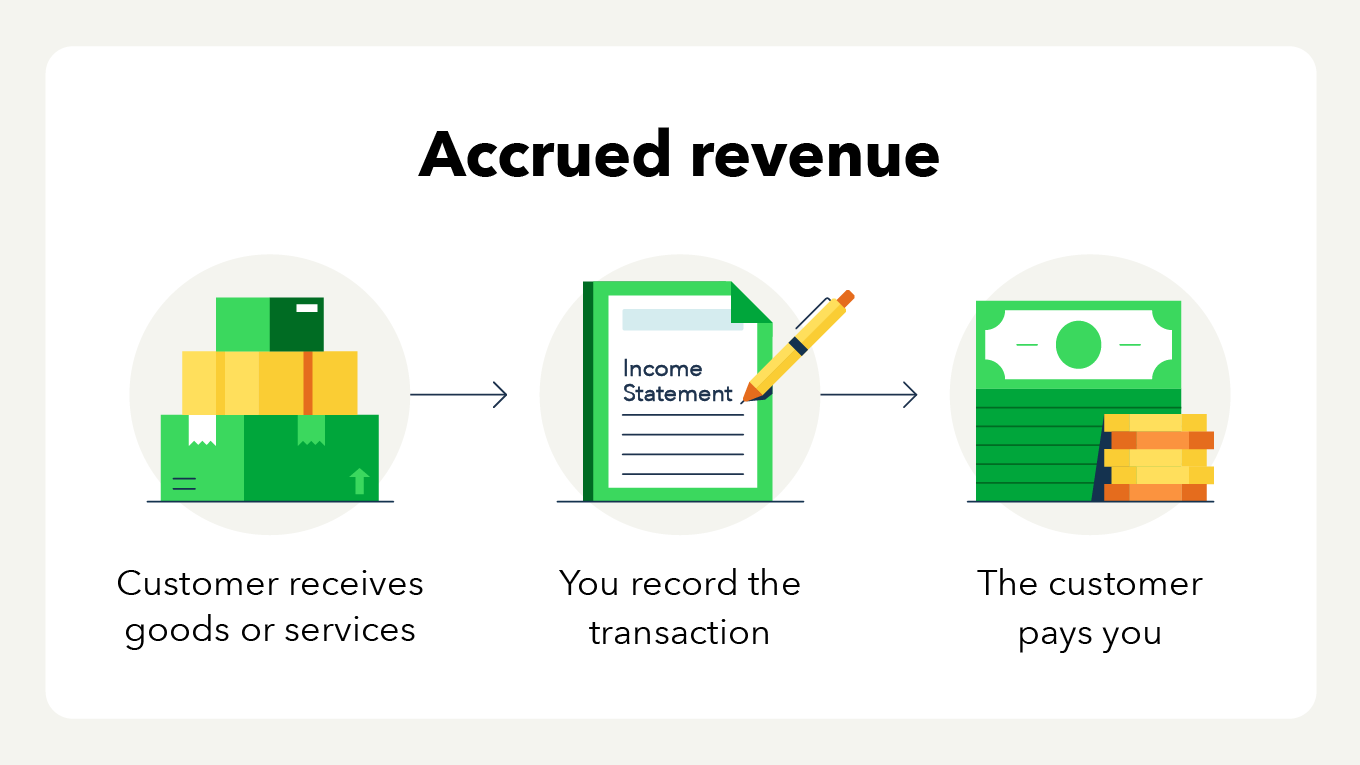

2. What Is Accrual Accounting?

Accrual accounting record incomes when it is earned as well as expenses that are it is incurred, no matter the time.

- A More Accurate Financial Illustration – reflects what you owe as well as what’s owed to you.

- is better in Growth & Planning – helps with forecasting and report.

- Ideal for Web 2.0 is the best choice for Startups seeking to grow or looking for funding.

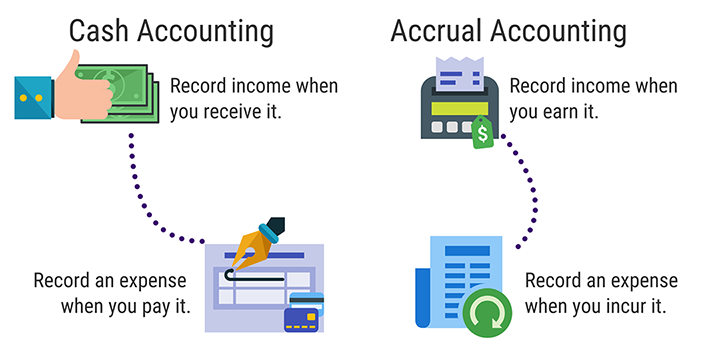

3. Key Differences at a Glance

| Feature | Cash Accounting | Accrual Accounting |

| Timing of Transactions | Cash is received, or due, it is paid. | If income is generated or expenses are incurred |

| Complexity | Simple | More detailed |

| Financial Accuracy | View limited | Comprehensive view |

| Tax Reporting | Easier for small businesses | Mandated for large companies. |

4. Which One Should You Choose?

- Cash Accounting is a great choice if you are looking for simplicity, and in-depth cash tracking.

- Accrual accounting is a better choice if you want to have detailed financial data and are planning to grow.

- Software like Xero Accounting software along with QuickBooks for small businesses can be used with both of them and make it simple to change as your company changes.

5. How Ceptrum Can Help

- Startup Accounting Services We assist you in choosing and apply the best approach.

- Small Business Bookkeeping Solutions that are tailored to the size of your company and its goals.

- Tax Assistance to Startups – Be sure to comply and maximise deductions.

Conclusion

If you decide to go with cash or accrual accounting , the most appropriate option is based on your business’s needs, goals as well as growth goals. With Ceptrum, startup accounting services that you do not have to do it all on your own.

Find expert solutions to financial problems on Ceptrum Select the accounting system you think best fits your startup!