In a highly regulated and competitive insurance landscape, the ability to accurately assess risk and determine premium rates is critical. This has led to the rise of Insurance Rating Software—a specialized class of solutions that enable insurers to efficiently develop, manage, and update rating models. These tools not only streamline operations but also improve compliance, customer experience, and profitability.

https://www.marketresearchfuture.com/reports/insurance-rating-software-market-24006

What Is Insurance Rating Software?

Insurance Rating Software is a digital platform that automates the process of calculating insurance premiums based on a variety of rating factors such as age, location, vehicle type, credit score, claims history, and more. It supports both commercial and personal lines and integrates with other systems like underwriting, policy administration, and customer relationship management (CRM).

Modern rating engines offer:

-

Rule-based pricing configuration

-

Real-time quote generation

-

Predictive modeling integration

-

Regulatory compliance tools

-

Cloud-based deployment options

Market Overview

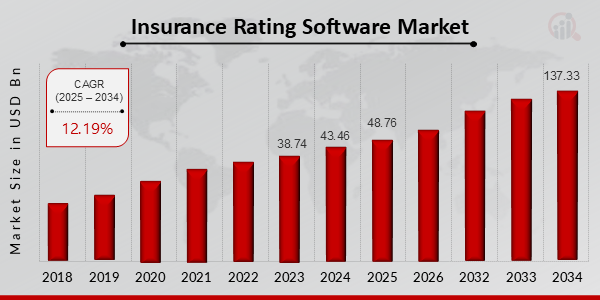

The global Insurance Rating Software market is growing steadily, driven by digital transformation, increasing competition in the insurance sector, and regulatory demands.

-

Market size in 2023: Estimated at USD 1.5–2 billion

-

Forecast for 2030: Expected to surpass USD 4 billion

-

CAGR: Projected to grow at 10–12% annually

Insurers of all sizes, including startups and large carriers, are investing in cloud-native and AI-powered rating platforms to gain an edge in pricing agility and risk management.

Key Drivers of Growth

1. Regulatory Compliance

Frequent changes in insurance regulations demand a system that can quickly update rating logic to remain compliant.

2. Customization and Speed

Insurance carriers need to deliver real-time quotes tailored to each applicant’s profile. Rating software enables high-speed calculations and flexible rule configurations.

3. Data-Driven Pricing

Advanced rating engines integrate with actuarial data, machine learning models, and external data sources (e.g., driving behavior, climate risk) to fine-tune premium accuracy.

4. Omnichannel Enablement

With more customers shopping online or via mobile apps, rating systems need to support consistent pricing across digital and traditional channels.

Key Features of Insurance Rating Software

-

Rating Algorithm Management

Easily define, modify, and test pricing rules for various lines of business. -

Multi-Line and Multi-State Support

Handle different insurance products and comply with regional regulations. -

Integration Capabilities

Seamlessly connect with policy administration systems, CRMs, and third-party data feeds. -

Real-Time Quoting

Deliver instant quotes to agents, brokers, and customers via portals or APIs. -

Cloud Deployment

Scale efficiently, reduce infrastructure costs, and enable remote collaboration.

Use Cases Across Insurance Lines

-

Auto Insurance: Real-time pricing based on telematics, driver history, and vehicle data.

-

Homeowners Insurance: Location-based rating that includes weather risk, building materials, and crime rates.

-

Life and Health: Dynamic rating that adapts to medical records, age, and lifestyle factors.

-

Commercial Insurance: Customized risk-based pricing for businesses based on industry, size, and claim frequency.

Regional Trends

-

North America: Leading in adoption due to a mature insurance ecosystem and focus on insurtech.

-

Europe: Strong demand for modular, compliance-focused rating systems due to diverse regulatory environments.

-

Asia-Pacific: Rapid growth in digital insurance platforms is fueling demand for scalable rating solutions.

-

Latin America and MEA: Emerging markets are beginning to adopt cloud-based platforms to modernize underwriting and pricing.

Challenges in the Market

-

Integration Complexity: Legacy system compatibility and data silo issues.

-

High Implementation Costs: Especially for small and mid-sized insurers.

-

Data Privacy and Security: Ensuring compliance with GDPR, CCPA, and other data regulations.

-

Shortage of Skilled Talent: Need for professionals who understand both insurance and technology.Future Outlook

The next generation of Insurance Rating Software will likely be shaped by:

-

AI and Predictive Analytics: For proactive risk identification and pricing optimization.

-

Low-Code/No-Code Interfaces: Empowering business users to modify rating logic without developer support.

-

Blockchain and Smart Contracts: Enabling transparent and auditable premium calculations.

-

Customer-Centric Models: Dynamic pricing based on behavior and real-time data.

Insurance Rating Software is no longer just a back-office tool—it’s a strategic asset. By enabling accurate, flexible, and compliant premium calculations, it empowers insurers to respond quickly to market changes, meet customer expectations, and maintain profitability.

As digital transformation accelerates across the insurance sector, investment in advanced rating systems will be crucial for staying competitive in the era of intelligent, responsive insurance.